san mateo county tax collector property tax

The law provides property tax relief to property owners if the value of their property falls below its assessed value. Typically property tax is 1 of the assessed value plus an amount to amortize voter-approved bonds and any fees for special assessments or charges such as mosquito abatement or sewer fees.

San Mateo County Postpones Property Tax Due Date Until May 4 Palo Alto Daily Post

You also may pay your taxes online by ECheck or Credit Card.

. Announcements footer toggle 2019 2022 Grant Street Group. If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax bill. Homeowners Property Tax Exemptions.

This recruitment schedule was amended on January 5 2022 to extend the FinalSee this and similar jobs on LinkedIn. Summary of Valuations of Property in the Assessment Rolls of the County. 3-days Left to Register by May 5 th.

2019 2022 Grant Street Group. You can also make a payment or get more information and assistance by calling us at 650 363-4155 and speaking to a Revenue Services staff member. Click here for Property Tax Look-up Assessor Maps Tax Saving Programs Search Grantee-Grantor Info Assessor Forms.

New property owners will automatically receive an exemption application in the mail. Canceled checkmoney order stub serves a. Contact Us Treasurer-Tax Collector Home.

The division assesses over 221000 units on the. FAQs What is the penalty for late payment of Unsecured Property taxes. Single Family is 3.

Center 1600 Pacific Hwy Room 162 San Diego CA 92101. Treasurer-Tax Collector San Diego County Admin. There is no charge for filing for the Homeowner Exemption.

Making a payment can be as easy as making a telephone call. Just call 1-877-496-0510 and use our interactive voice response system. The median property tax on a 78480000 house is 580752 in California.

Pay Property Taxes Pay Property Taxes Offered by County of San Mateo California taxmastercosanmateocaus 650 363-4142 PAY NOW View your current San Mateo county property tax statements secured unsecured and pay them online using this service. Generally property is assessed at the lesser of two values. SEARCH SELECT PAY ITS THE BEST WAY.

The property tax process in San Mateo County like most other California Counties is split between three different offices - the Assessor the Controller and the Tax CollectorTreasurer. Total Ad Valorem Taxes. You can then pay by credit card right over the phone.

For more information call 6503634501. Enter a Parcel Account Property Address or Bill YYYY- Loading Search. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner.

Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less. 2022 Property Tax Re-offer Auction. City Of San Mateo Bond.

Pay Transient Occupancy Tax. However they are still required to file a statement if requested by the Assessor. Search and Pay Business License.

In fulfilling these services the Division assures that the County complies with necessary legal. Mateo countysan supplement al 6 uesval 66 exeem tax statement 9v a l u e s additional tax for fiscalyear parcel number. The median property tax on a 78480000 house is 824040 in the United States.

The treasurer tax Collector or treasurer instead of the 913 San Patricio tax Assessor-Collector years and the GIS. The factored base year value typically the purchase price adjusted annually for inflation not to exceed 2 percent per year or current value on January 1. Enter a Parcel Account Property Address or Bill YYYY-.

The Tax Rates and Valuation of Taxable Property of San Mateo County publication includes. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. Contact Property Tax Accounting Staff if you have questions relating to refunds.

In San Mateo County the heads of these offices are elected officials. Sandie arnott tax collector san mateo county 555 county center 1st floor redwood city ca 94063 after add 10 penalty. Search and Pay Property Tax.

Assessed Valuation by Account. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in San Mateo County.

Secured Property Taxes Tax Collector

San Mateo County Ca Property Tax Search And Records Propertyshark

Fill Free Fillable San Mateo County Law Library Pdf Forms

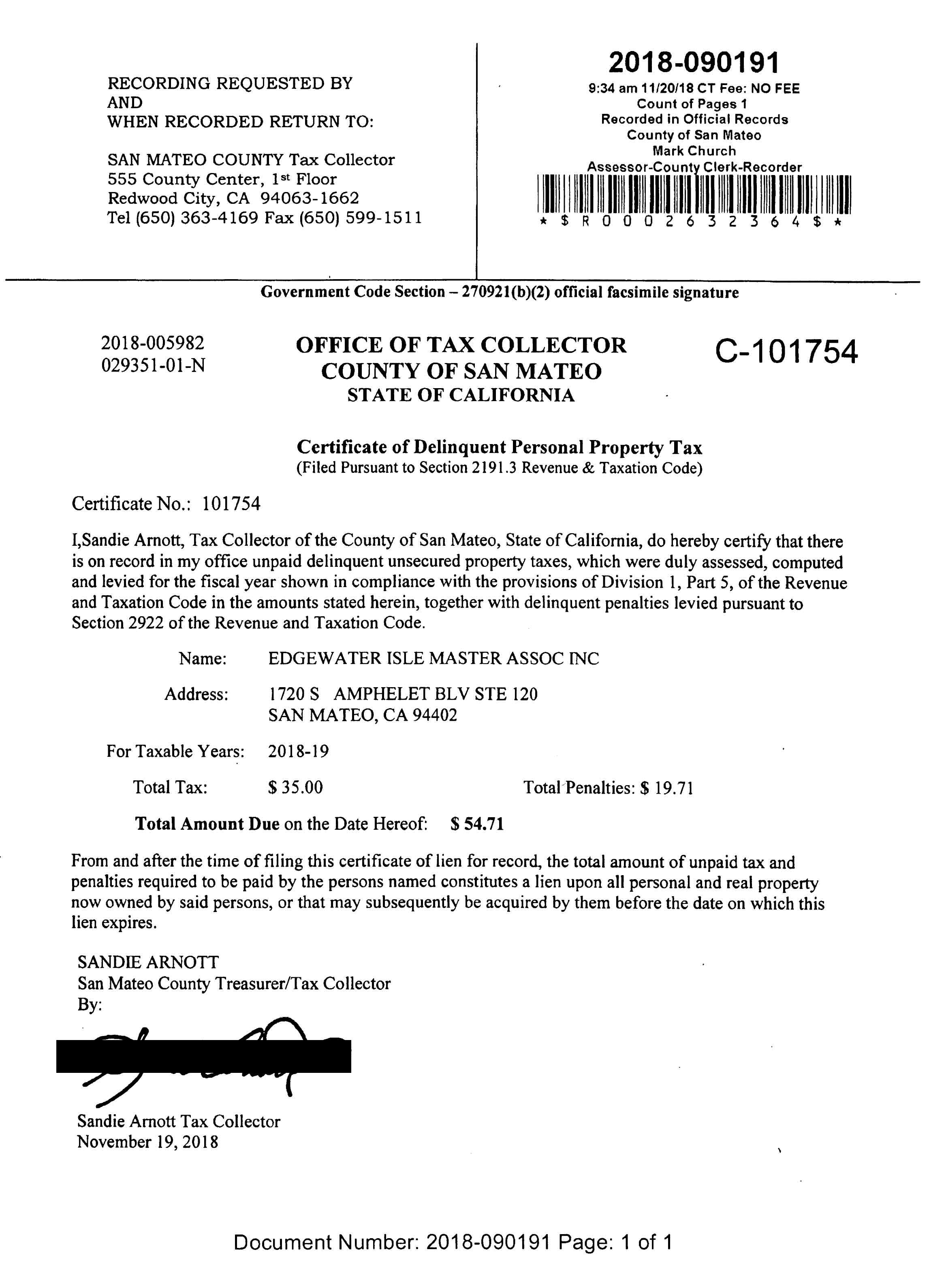

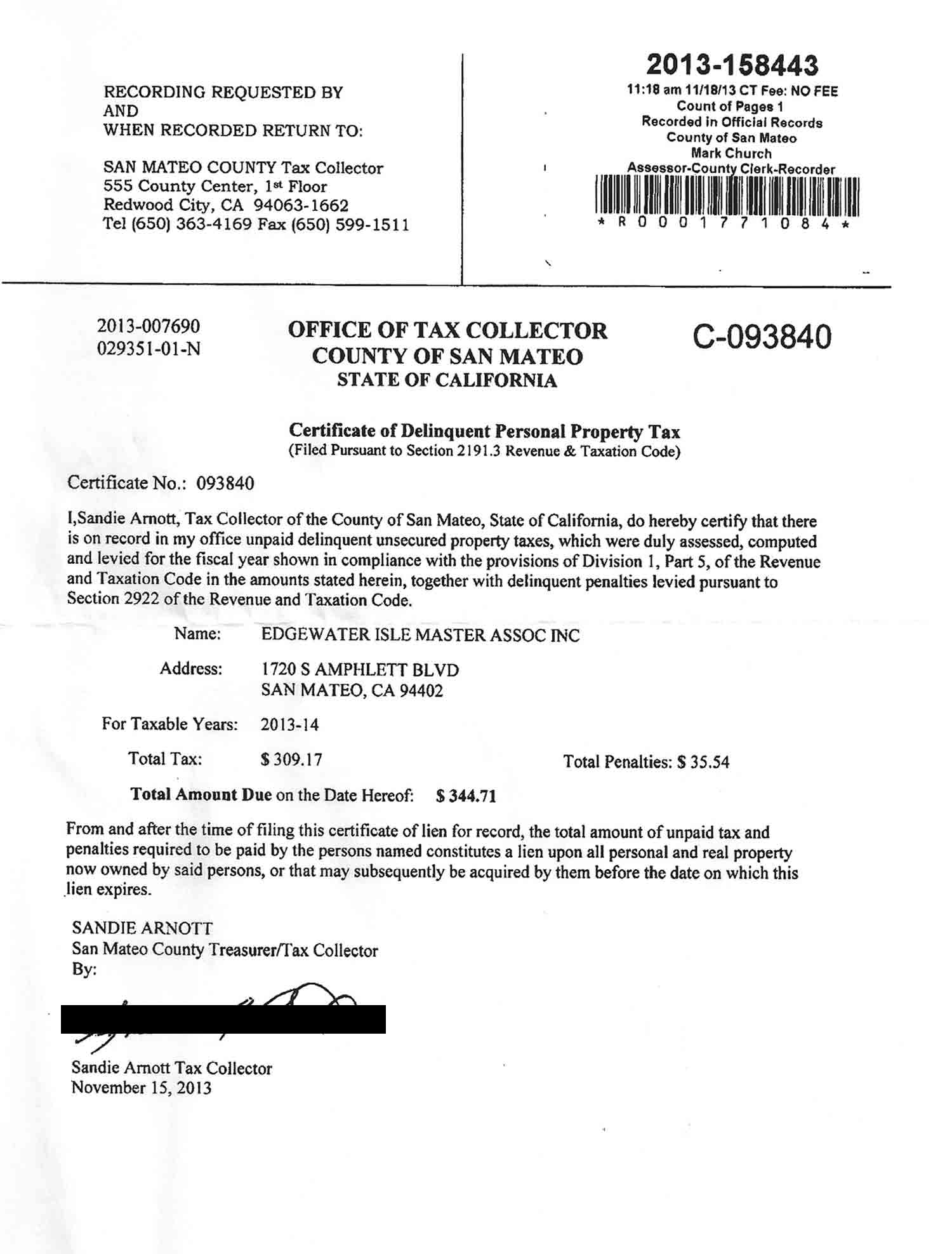

San Mateo County Issues Liens Against Master Association

Secured Property Taxes Tax Collector

Secured Property Taxes Tax Collector

County Of San Mateo Government Quick Tip Tuesday Some Santa Clara County Taxpayers Reported Receiving Bogus Letters Like The One Pictured In This Post From A Non Existent Tax Lien Office

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

San Mateo County Ca Property Tax Search And Records Propertyshark

Sandie Arnott For Treasurer Tax Collector 2022

San Mateo County Issues Liens Against Master Association

San Mateo County Issues Liens Against Master Association

San Mateo County Ca Property Tax Search And Records Propertyshark

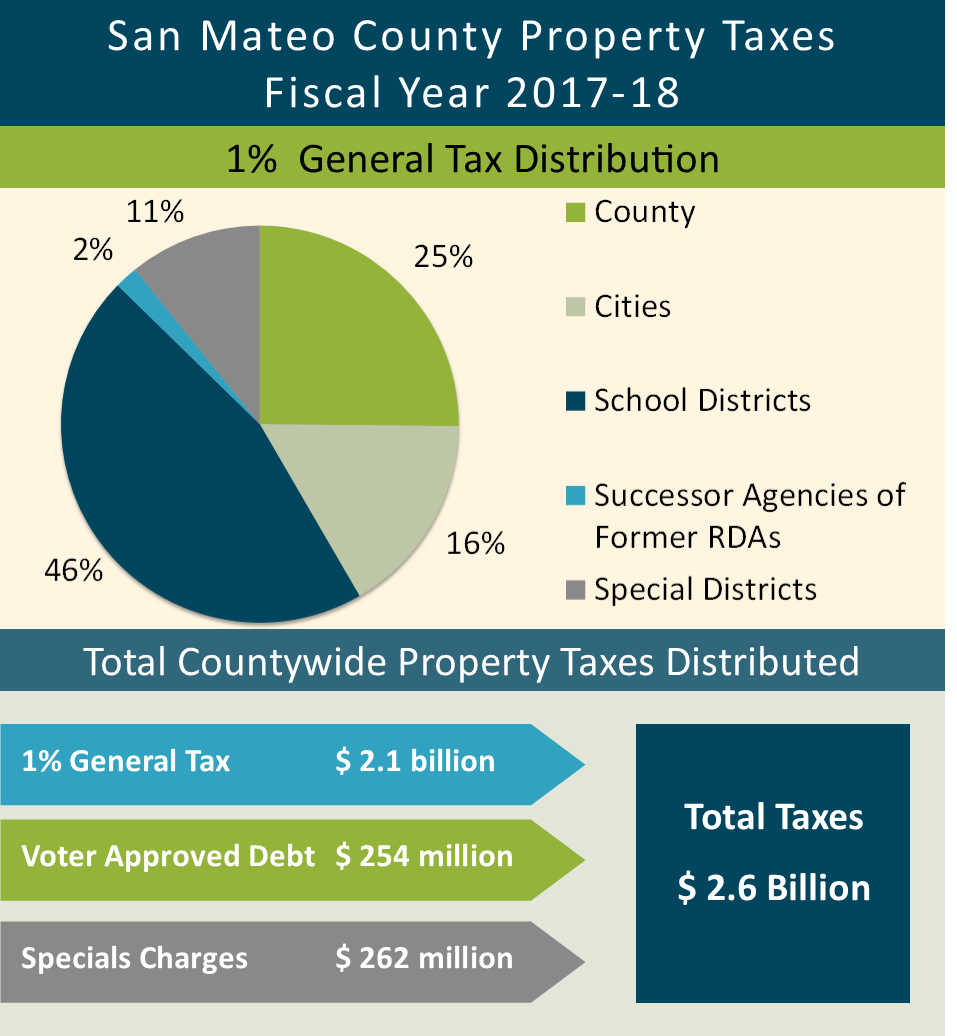

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

County Of San Mateo Government Quick Tip Tuesday It S That Time Of Year Again Secured Property Taxes Are Due By 5 P M On Dec 10 Payments May Be Made Online

San Mateo County Ca Property Tax Search And Records Propertyshark