maine excise tax rate

Title 36 1482 Excise tax. 1 City Hall Plaza Ellsworth ME 04605.

Maine Sales Tax On Cars Everything You Need To Know

Share this Page How much will it cost to renew my registration.

. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. 22500 X 0100 225. 18 rows The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500.

- NO COMMA For. To calculate your estimated registration. This calculator is for the renewal registrations of passenger vehicles only.

The rates drop back on January 1st each year. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right. The excise tax you pay goes to the construction and.

Other registration fees are collected and forwarded to the State of Maine. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. These rates apply to the tax bills.

Maine residents that own a vehicle must. Contact 207283-3303 with any questions regarding the excise tax calculator. 16 rows 1 CNG Hydrogen and Hydrogen CNG tax rate is applied to every 100 cubic feet.

The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. For the privilege of operating a motor vehicle or camper trailer on the public ways each motor vehicle other than a stock race car or each camper trailer to be so. Enter your vehicle cost.

Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. The excise tax is based on the sticker price or original list. For example a 3 year old car with an MSRP of 19500 would.

For any commercial vessel the tax payable shall be 50 of the value due under subsection 1. For all other watercraft the tax payable shall be reduced 20. Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due.

Departments Treasury Motor Vehicles Excise Tax Calculator. How much will it cost to renew my. 13 rows Tax Rates Maine Revenue Services Tax Rates The following is a list of individual tax rates applied to property located in the unorganized territory.

B 9 NEW B. The excise tax you pay goes to the construction and. An excise tax is paid and kept by Cape Elizabeth.

The rates drop back on January 1st each year. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. Monday-Friday 8AM to 5PM.

Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen.

2018 Maine Tobacco Use Fact Sheet

Maine Income Tax Calculator Smartasset

How Do State And Local Property Taxes Work Tax Policy Center

Maine Resale Certificate Form Fill Out And Sign Printable Pdf Template Signnow

Historical Maine Tax Policy Information Ballotpedia

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Northeast Cigarette Tax Rates Map 2013 02 21

Vehicle And Trailer Registration Town Of Easton Maine

Maine Alcohol Taxes Liquor Wine And Beer Taxes For 2022

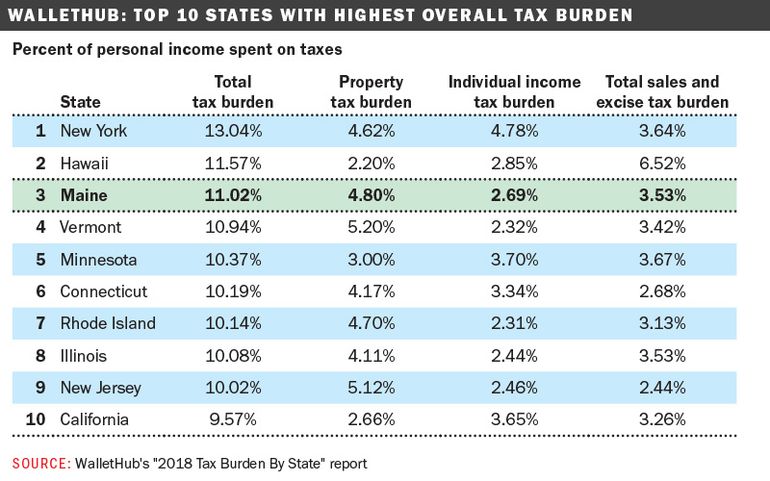

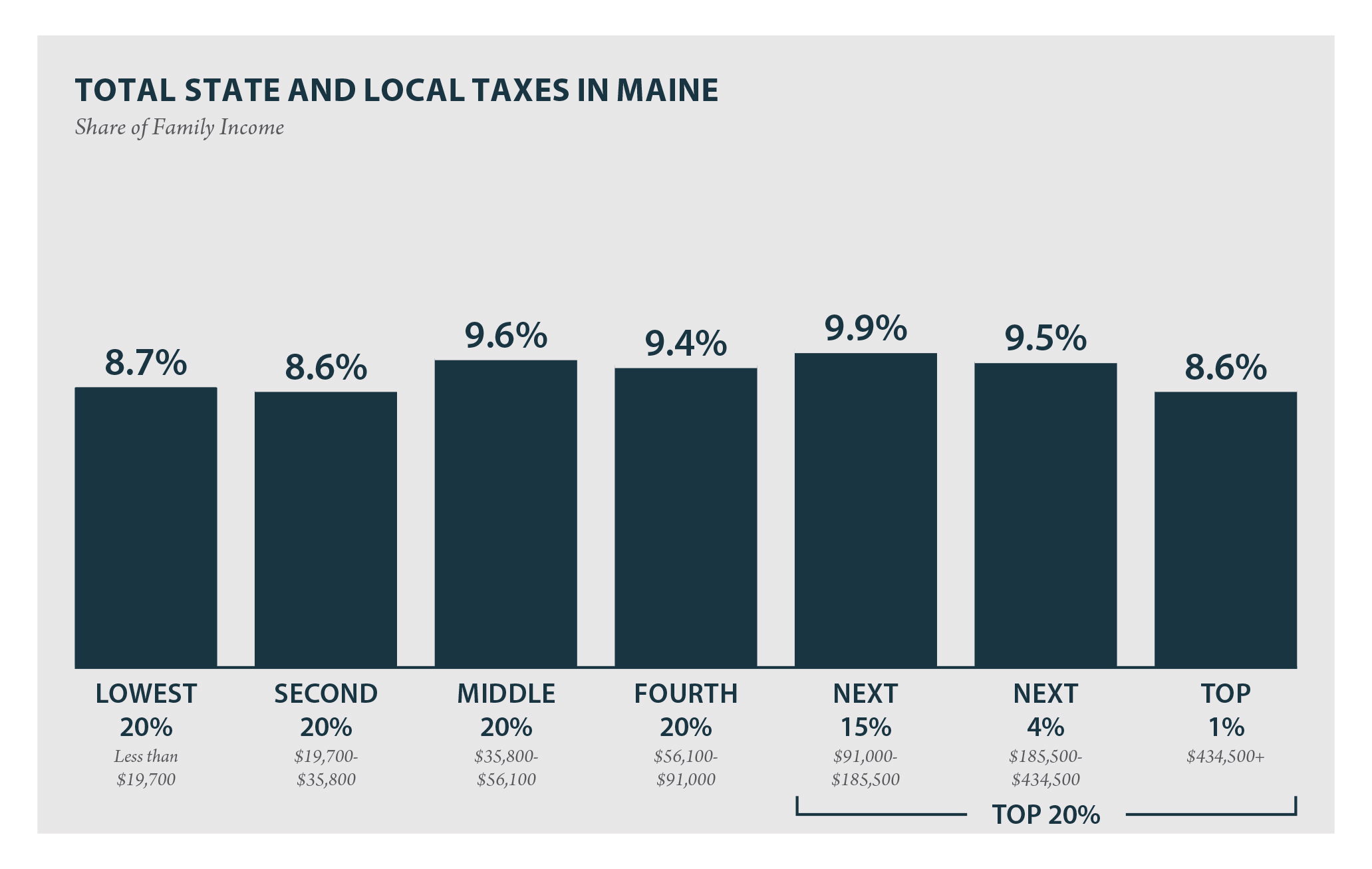

Maine Who Pays 6th Edition Itep

Want To Lower Maine S Tax Burden Don T Forget To Consider Raising Incomes

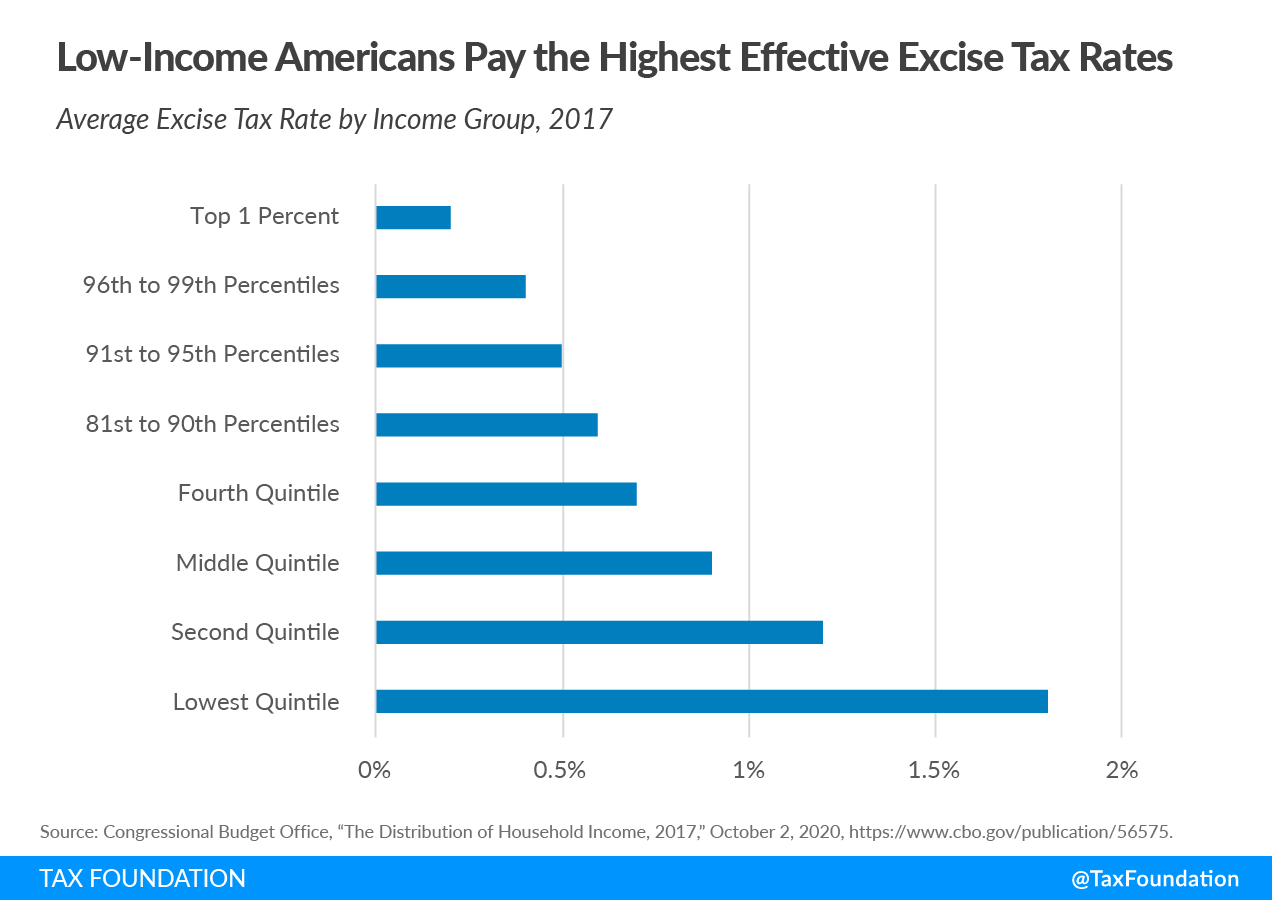

Excise Taxes Excise Tax Trends Tax Foundation

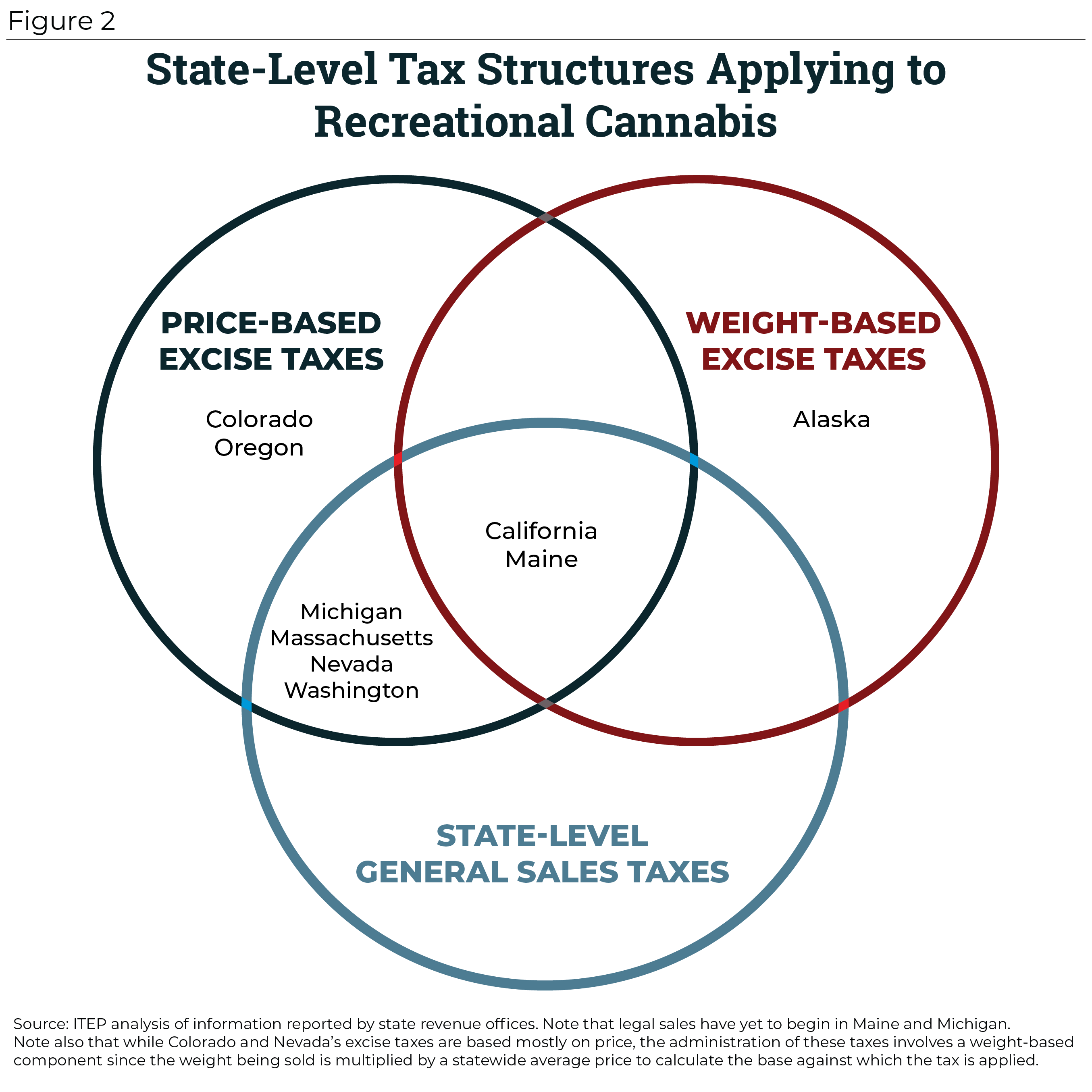

How Do Marijuana Taxes Work Tax Policy Center

Why Maine License Plates Jam Out Of State Highways Portland Press Herald

State Tax Levels And Tax Progressivity Lane Kenworthy

Publications Research Amp Commentary Taxing Alcohol Would Not Reduce Suicides Or Domestic Violence In Maine Heartland Institute